The free trade agreement between Vietnam and the European Union (EVFTA) and the investment protection agreement IPA was officially approved by the European parliament in February 2020 and approved by the Vietnamese parliament in June. / 2020, officially effective from 1 August 2020. This agreement is considered to be an important boost to Vietnam's economic growth in the next 5-10 years, in addition it also makes sense to contribute to diversifying Vietnam's export and import markets, contributing to ensuring the economic security.

Recently, SSI Research has released a report assessing the impact of the EVFTA Agreement on Vietnam's garment industry. According to SSI Research, the profitability of the textile and garment industry will depend on the domestic fabric supply capacity in the next 2 years.

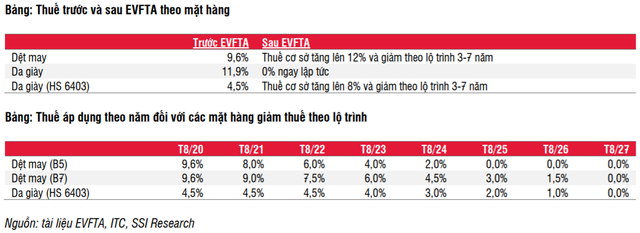

Before EVFTA, Vietnam's textile and footwear exports to the EU were enjoying preferential treatment under the standard GSP regime, of which the EU garment import tax on goods originating from Vietnam was 9.6. % for garments and 11.9% for footwear. After the EVFTA comes into effect, most textile and garment products will enjoy a tax reduction of 0% according to a 5-year schedule (accounting for 77.3% of export turnover of main items) or 7 years (22.7% remaining). again). Meanwhile, most leather and footwear products will receive an immediate tax reduction of 0%.

To enjoy tax incentives under EVFTA, textile enterprises need to use domestically produced fabrics or imported fabrics originating from Korea. Currently, Vietnam's textile and footwear products are still dependent on 60-70% on imported materials from China. Fabric imported from Korea only accounts for 15% of total fabric demand. Currently, Chinese fabrics are 10-40% cheaper than locally produced fabrics depending on the type, so a tax incentive of 12% (12% MFN tax rate will be applied after 2 years in the school). Enterprises that do not meet EVFTA standards) are not attractive enough for businesses to switch to using domestic fabrics.

According to SSI Research, in order to take advantage of tax incentives, Vietnam needs to develop a textile-dyeing industry in order to increase the proportion of domestically produced fabric, and to ensure sufficient scale to compete on cost compared to Chinese fabric.

SSI Research assessed that in the short term, textile enterprises are not able to enjoy tax incentives of EVFTA due to (1) Import tax on the EU market will be gradually reduced according to the roadmap, in which at the earliest, it must be from August. / 2021 new businesses can enjoy tax incentives; (2) The shortage of fabric materials in the country is still the bottleneck of the industry that prevents businesses from meeting EVFTA's rules of origin requirements. Meanwhile, the cost of fabric imported from China is 30% lower than the cost of fabric produced in Vietnam, the delivery time is faster due to the availability of inventory thanks to large production scale, making fabric production. It is difficult for the country to compete and (3) The impact of the Covid-19 epidemic continues to put pressure on the demand for apparel in the world in general and the EU market in particular.

Within the first 2 years (8 / 2020-8 / 2022), businesses can choose to continue to be taxed under the GSP regime or under EVFTA, so SSI Research thinks that most businesses will continue to choose GSP tax regime (9.6%) because this is lower than the EVFTA tax rate and enterprises have not been able to convert raw materials in time. However, from the third year onwards, if the enterprise does not meet the rules of origin as stipulated by EVFTA, the tax rate will increase to 12% - the base tax rate under the MFN regime.

In the tax incentive transition schedule, within the next 5 years from the third year, enterprises can still choose the incentives under GSP or EVFTA, but regardless of the tax incentive level, they must ensure compliance rules of origin as defined by EVFTA. Thus, in case the enterprise does not guarantee the rule of origin from year 3 onwards, the enterprise will not enjoy any tax incentives (GSP or EVFTA), and the default tax rate will be the tax rate. under the MFN regime (12%).

However, SSI Research believes that the tax incentives of EVFTA are considered not attractive enough for businesses to actively transfer raw materials supplies from China to the country, according to Vinatex, due to Chinese fabric prices. Quoc is still about 30% lower than the price of domestic fabric, not to mention the faster delivery time (Chinese fabrics can deliver within 10 days compared to domestic fabric which usually takes 40-60 days). These advantages come from the size of the Chinese textile and dyeing industry - China's production capacity is 80 billion meters of fabric per year, compared with Vietnam's current production capacity of 2.5 billion meters of fabric, and total fabric demand in Vietnam is about 8 billion meters.

https://cafef.vn/ssi-research-kha-nang-huong-loi-cua-nganh-det-may-tu-evfta-se-phu-thuoc-vao-nang-luc-cung-ung-vai-noi-dia-trong-2-nam-toi-20201027173514303.chn

Source: cafef.vn